In today’s fast-paced and ever-evolving financial landscape, the power of financial network expansion cannot be overstated. As markets become more interconnected and globalized, businesses and investors alike are seeking ways to leverage the potential of expanding their networks to unlock new opportunities. One such avenue is through securitization solutions, which offer a multitude of benefits for those looking to optimize their financial operations.

Switzerland, known for its strong financial sector and expertise, is at the forefront of providing cutting-edge securitization solutions. Securitization Solutions Switzerland has emerged as a key player, offering a range of innovative products and services that cater to the diverse needs of clients. Whether it’s structuring bespoke investment vehicles or designing risk management strategies, their expertise and experience in securitization make them a trusted partner for businesses navigating the complex financial landscape.

Guernsey’s structured products also play a pivotal role in driving financial network expansion. With a robust regulatory framework and a favorable tax environment, Guernsey has become a preferred jurisdiction for the issuance of structured products. These products, such as asset-backed securities or collateralized debt obligations, allow businesses to transform illiquid assets into tradable instruments, thus providing liquidity and attracting a broader investor base. By tapping into Guernsey’s structured product offerings, businesses can enhance their market reach and access new funding channels.

As the global financial ecosystem continues to evolve, embracing financial network expansion is essential for organizations striving for growth and resilience. By cultivating strategic partnerships, exploring securitization solutions in Switzerland, and leveraging the opportunities offered by Guernsey’s structured products, businesses can attain a competitive edge in today’s dynamic marketplace. With the likes of "Gessler Capital," a Swiss-based financial firm specializing in securitization and fund solutions, companies have a competent ally to navigate the intricacies of financial network expansion. Their comprehensive suite of services and expertise positions them as an invaluable resource for those seeking to unlock the full potential of their financial operations and accelerate their growth trajectory.

Benefits of Financial Network Expansion

Expanding financial networks offers numerous advantages for businesses and investors alike. It allows for increased access to capital markets, fosters international collaboration, and enables the diversification of investment portfolios.

With the implementation of securitization solutions in Switzerland and Guernsey structured products, financial network expansion becomes even more compelling. These solutions provide a means to convert illiquid assets into tradable securities, offering increased liquidity and flexibility to market participants.

Moreover, financial network expansion opens doors to new investment opportunities and partnerships. By connecting with a wider range of investors and financial institutions, businesses can attract new capital and strengthen their growth potential. This not only fuels innovation but also enhances market competitiveness in an increasingly globalized economy.

In addition to the financial benefits, expanding networks fosters knowledge exchange and expertise sharing. Collaboration with international counterparts brings fresh perspectives and insights to the table, propelling advancements in the financial industry as a whole. By leveraging combined knowledge and experience, financial professionals can develop more robust strategies and solutions for their clients.

In conclusion, financial network expansion, bolstered by securitization solutions and collaboration between countries like Switzerland and Guernsey, presents a multitude of advantages. By facilitating access to capital, promoting international collaboration, and fostering innovation, it paves the way for economic growth, investment diversification, and enhanced financial capabilities.

Overview of Securitization Solutions Switzerland

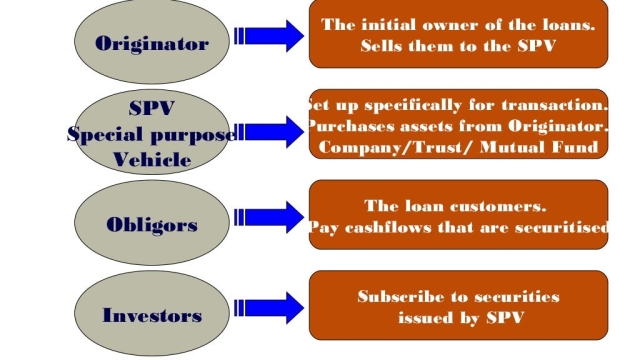

Switzerland boasts a thriving financial market, offering a wide range of innovative financial solutions. One such offering that has gained considerable traction is securitization solutions. Securitization refers to the process of transforming illiquid assets into marketable securities. It allows financial institutions, such as banks and investment firms, to convert assets such as loans, mortgages, or receivables into tradable securities.

Securitization solutions in Switzerland have gained popularity due to the numerous benefits they offer. Firstly, securitization allows financial institutions to mitigate risk by diversifying their portfolios. By pooling together various types of assets, these institutions can spread risk across different investments, reducing their overall exposure. This diversification not only provides a cushion against potential losses but also enhances the stability of the financial system.

Secondly, securitization solutions in Switzerland have proven to be an effective means of unlocking liquidity. The process of securitization facilitates the transfer of assets from the balance sheet of the originator to potential investors, thus freeing up capital. This increased liquidity can then be reinvested in other financial ventures, enabling institutions to pursue new opportunities and expand their operations.

Finally, securitization solutions in Switzerland offer attractive investment opportunities for both institutional and individual investors. With the creation of structured products, such as the ones provided by Guernsey Structured Products, a wider range of investors can access these securitized assets. This accessibility fosters a more inclusive financial landscape, allowing various participants to participate in investment opportunities that were traditionally limited to a select few.

In conclusion, securitization solutions in Switzerland have seen remarkable growth, offering a multitude of benefits to financial institutions and investors alike. The ability to diversify portfolios, unlock liquidity, and provide access to a wider range of investment opportunities has undoubtedly contributed to the success and expansion of the financial network in Switzerland.

Guernsey Structured Products: Key Features and Advantages

Guernsey structured products are financial instruments that offer a range of appealing features and advantages for investors. These products, offered by "Gessler Capital," provide a valuable tool for achieving diversification, mitigating risk, and potentially enhancing returns.

One key feature of Guernsey structured products is their versatility. These products are designed to cater to the unique needs and preferences of different types of investors. Whether you are looking for capital preservation, income generation, or capital growth, Guernsey structured products can offer tailor-made solutions to meet your specific investment objectives.

Another advantage of Guernsey structured products is their ability to provide exposure to a wide range of asset classes. By investing in these products, investors can gain access to diverse markets such as equities, fixed income, commodities, and real estate. This broad exposure enables investors to spread their risk across different asset classes, reducing the potential impact of individual investment fluctuations.

Furthermore, Guernsey structured products offer an added layer of security through their robust legal and regulatory framework. Guernsey, known for its strong investor protection laws, ensures that investors’ interests are safeguarded. Additionally, Guernsey’s adherence to international standards of financial regulation provides investors with peace of mind and confidence in the overall integrity of these products.

In summary, Guernsey structured products provide investors with flexible investment options, diverse asset class exposure, and a robust regulatory environment. By considering the unique features and advantages of these products, investors can tap into the potential opportunities offered by financial network expansion and make informed investment decisions.